- November 8, 2025

- Posted by: Regent Harbor Team

- Category: Global Economy

markdown

Contents

Palantir Technologies: A Remarkable Journey

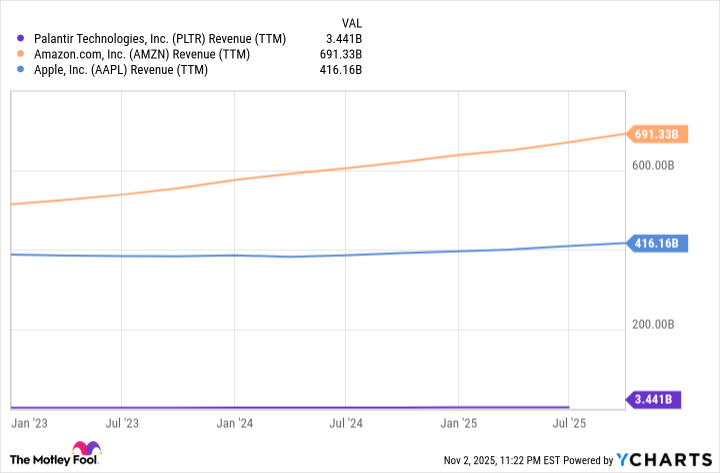

Palantir Technologies, an intriguing player on the stock market, has been a significant win for investors. Over the past year, the stock has surged by nearly 400%, boasting a market cap of $475 billion. Indeed, this is no small feat. However, Palantir’s niche market presents limitations. If its business model remains unchanged over the next decade, its reach may remain more restricted compared to broader industries.

The Challenges Ahead

For Palantir to compete with giants like Amazon and Apple, there are hurdles to overcome. At present, it trades at an exceptional valuation of 147 times trailing 12-month sales. To match Amazon’s current market cap, Palantir would require another monumental increase, which appears unlikely. Moreover, the price-to-sales ratio may decline over the next ten years, posing additional challenges.

Amazon’s Diverse Portfolio

Amazon is a behemoth with tentacles in various sectors. From dominating 40% of U.S. e-commerce to leading in cloud computing through Amazon Web Services (AWS), its influence spans far and wide. Recently, AWS sales growth accelerated, reaching over 20% in the third quarter. CEO Andy Jassy highlighted a $200 billion backlog, signaling promising times ahead.

Expanding Horizons

Amazon is making rapid strides in service expansion. It increased rural community deliveries by 60% within just four months. The same-day grocery delivery is now available in over 1,000 cities, with aspirations to reach 2,300 by year-end. These moves are expected to bolster sales considerably.

10 stocks we like better than Amazon ›

Apple’s Unparalleled Ecosystem

Apple continues to be the darling of consumer tech, maintaining a firm grip on the market. The iPhone, being the most popular in the U.S., underpins a formidable ecosystem. The recent iPhone 17 launch has met with exceptional demand, ensuring the Apple’s star continues to shine brightly.

Lucrative Ventures

Apple’s product lineup transcends just phones. It includes Macs, iPads, and AirPods, bolstered by subscription services like streaming and fitness. Although not as varied as Amazon’s revenue streams, Apple’s high-margin ventures sustain its dominance.

Final Thoughts and Spectacular Returns

In ten years, the market landscape will likely transform. Nonetheless, Amazon and Apple, with their robust consumer bases, are likely to remain larger than Palantir. For prospective investors, there are intriguing opportunities.

Stock Advisor’s average return outpaces the market by a staggering 1,034%, compared to 191% for the S&P 500. Do explore the latest top ten list from Stock Advisor.

This article was originally published by The Motley Fool.