- February 8, 2025

- Posted by: Regent Harbor Team

- Category: Global Economy

Contents

Global Economic Overview

You see, the global economy has been quite the topic of conversation lately. With President Trump’s tariff threats, economists worldwide worry about another wave of inflation. Interestingly, while these concerns haunt many, the appetite for gold remains insatiable. It appears that no one, not even central banks, can resist the lure of gold. Last year, Poland, India, and Turkey led the charge, buying a whopping 1,045 metric tons.

The US Labour Market and Manufacturing

As the year kicked off, US job growth showed signs of moderation. A little surprise, isn’t it? Particularly after such robust hiring in prior months. This cooling might be due to a wintry chill and those pesky wildfires near Los Angeles. The Fed seems unfazed, though. They’re taking a more patient stance on interest rates while hoping for inflation to subside.

Nonetheless, manufacturing in the US has brightened considerably. Recent data suggests factory activity is on an upswing. New orders have seen their strongest growth since last year, indicating producers are upping their game to meet the surge in demand.

European Economic Movements

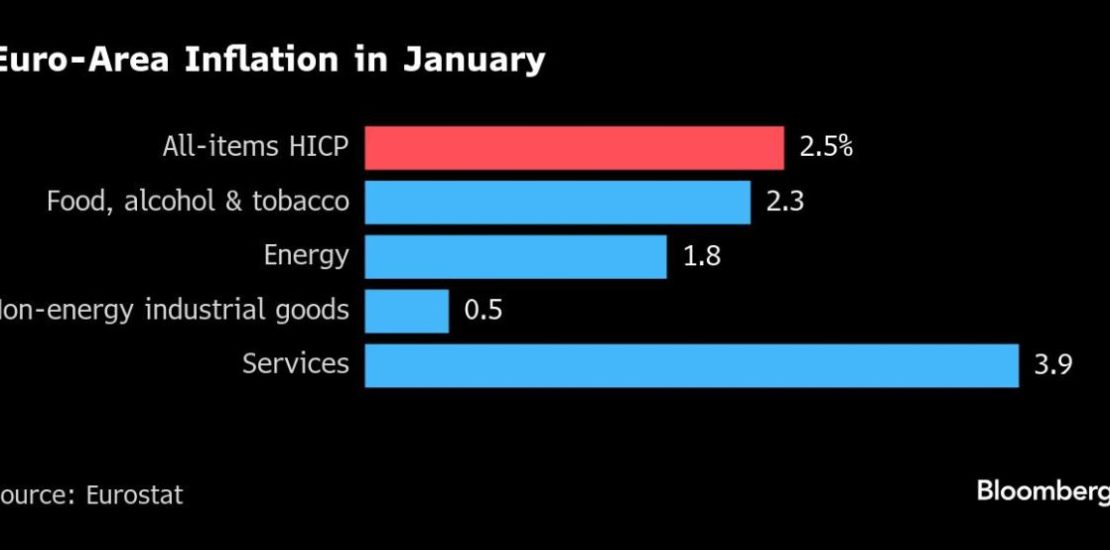

The gossamer web of Europe’s economy is no less intriguing. The euro area’s inflation unexpectedly accelerated, giving the European Central Bank pause about interest rate cuts. Meanwhile, the Bank of England recently decided to reduce interest rates to levels not seen in 19 months. Governor Andrew Bailey rather agrees with Chancellor Rachel Reeves‘ growth plans, though currently, official forecasts seem to suggest otherwise.

Moreover, Germany’s industrial production has taken a dive, especially in areas like cars and machinery. Yet, other statistics hint at stabilization, a curious contradiction indeed.

Shifts in the Asian Markets

Turning our gaze eastward, Japan is witnessing an upswing in household spending, quite a spectacle not seen since August 2022. Thanks to generous bonuses, it seems consumers have visited the shops with gusto. And over in China, the Lunar New Year festivities led to record-breaking travel and film-watching, with receipts reaching a hefty $1.3 billion. However, not everything is rosy, as China has placed export controls on tungsten, a strategic metal critical to weapons production.

Developments in Emerging Markets

On the topic of emerging markets, Brazil is in a bit of a spot. Their central bank foresaw inflation running rampant over the next six months. This is largely due to rising food prices and stubbornly high service costs. Despite several aggressive hikes in interest rates, the situation remains challenging.

Diverse Monetary Policies Around the World

Diverse monetary policies are being enacted globally. While Iceland, Mexico, and Kenya each trimmed borrowing costs by half a percentage point, countries like Poland and Uganda opted to hold interest rates steady. Most notably, India reduced its rates for the first time in over five years, an interesting move by any measure.

In conclusion, as we sip our tea and ruminate over these economic developments, it is clear that the world’s monetary landscape remains as complex as ever. Whether it’s the buying spree for gold or the nuanced dance of interest rates, these tales from the global economy are nothing if not captivating.