- September 11, 2024

- Posted by: Regent Harbor Team

- Category: Global Economy

Inflation Continues to Decline: A Turning Point for the Federal Reserve?

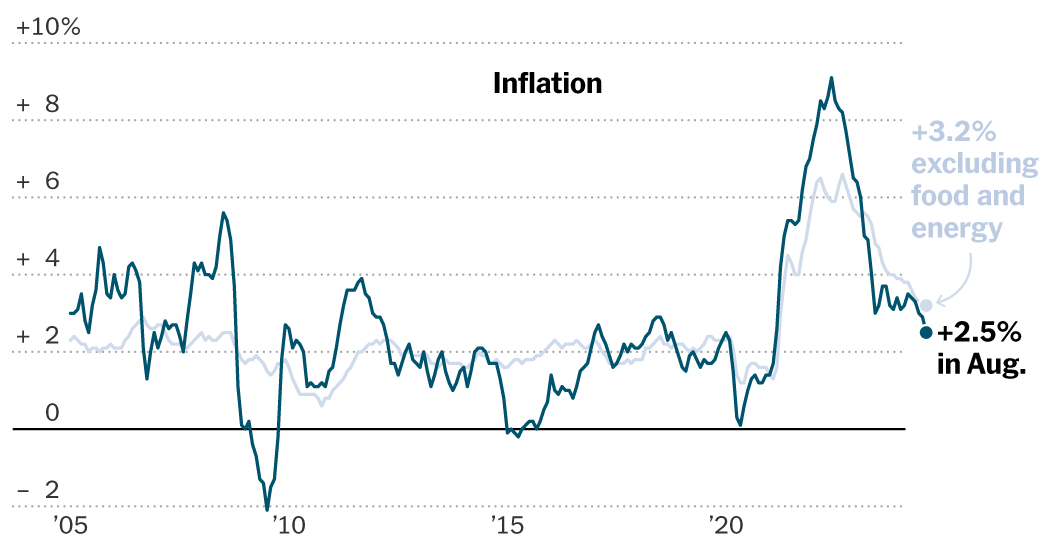

Inflation has been gradually slowing, paving the way for the Federal Reserve to potentially lower interest rates for the first time since early 2020 at their upcoming meeting.

Federal Reserve’s Dilemma

High interest rates act as brakes on the economy, causing activity to slow down. As demand recedes, it becomes difficult for businesses to raise prices. However, the Fed must tread carefully, as keeping rates too high for too long could lead to increased unemployment and risk a recession.

Sluggish Yet Promising Signs

Despite the overall Consumer Price Index climbing 2.5 percent in August, a notably cooler pace than July’s 2.9 percent, certain stubborn signs beneath the surface warranted attention. A measure of housing prices, for instance, has proven surprisingly resilient, contributing significantly to overall inflation. Shelter costs could prevent the pace of price increases from fully returning to the Fed’s goal.

Slow and Steady Wins the Race

Signs of stubborn inflation may evoke caution, but they are not enough to change the overall narrative. Inflation has been slowing down gradually, allowing for a careful shift in policy. Officials aim to defeat rapid price increases without tanking the economy.

“I still think they are confident enough to proceed with rate cuts, but it suggests: Don’t go super fast here,” said Laura Rosner-Warburton, senior economist and founding partner at MacroPolicy Perspectives.

The Importance of Incoming Data

Officials have been meticulously monitoring incoming inflation and employment data. This information is crucial as they contemplate their next moves both at the upcoming two-day meeting and in the months to come.

“Soft landings are as much about luck as skill, and the luck part is in knowing when to say ‘we’re done’ and cut,” said Diane Swonk, chief economist at KPMG.

Next week, policymakers will release fresh quarterly economic forecasts. This will provide a clearer indication of their future plans, outlining a rough path for rates ahead.

Complications in the Housing Market

Rosner-Warburton expects housing costs to fade in the months to come, though bumps are anticipated. For example, used car costs are expected to rise this fall, as sometimes one-offs can affect price increases. August saw a pop in airfares, helping to push up monthly inflation.

“The direction of travel is still clear,” she said. “It’s about the speed, and whether it’s linear.”

Impact on the Markets

Stocks sank after the report, indicating that investors feared lingering inflation could complicate rapid rate cuts. However, the continued cooling in overall headline inflation might have positive implications for Main Street. As price increases align more closely with the Fed’s goal, consumers might feel like they are finally catching up. Wage growth has been faster than price increases for over a year by several measures.

A Political Implication?

This moderation in inflation is good news for the Biden administration, which has found it challenging to take credit for economic wins due to rising prices tarnishing consumer confidence.

“With inflation coming back down close to normal levels, it is important to focus on sustaining the historic gains we have made for American workers during this recovery,” remarked Lael Brainard, head of the White House National Economic Council, following the report.

The Fed’s move next week could indeed mark a significant turning point, providing a clear statement that central bankers believe they are nearing victory against inflation, even if the battle isn’t fully won. As inflation, which first took off in early 2021, continues to cool, the economy might finally be approaching a sense of normality.