- June 1, 2025

- Posted by: Regent Harbor Team

- Category: Global Economy

Contents

Global Economic Outlook: A British Perspective

The global economic outlook has taken a rather disheartening turn this year. Worsening prospects for international trade and broad-based economic weakness have emerged, changing expectations quite dramatically.

A Promising Start

Initially, there was an air of cautious optimism. The year began with hopeful signs of stable growth, aided by policy easing from major central banks and resilient performances from both the US and the Euro Area. Even China showed signs of cyclical recovery, and all these developments were spilling over positively into the global economy.

Shift in Sentiment

However, the mood shifted sharply in February. The new US administration embarked on an ambitious policy agenda that has had significant global implications. This aggressive stance led to increased trade uncertainties, particularly after the so-called “Liberation Day.” As a consequence, expectations for global growth have been significantly downgraded.

Trade Tensions and Economic Impact

The primary factor behind this revised outlook is the escalation of trade tensions. Rising geopolitical issues and policy discord have instilled uncertainty among investors and consumers alike. Particularly affected are countries dependent on export-led growth strategies. For example, trade-intensive Asian nations, a gauge of global commercial activity, have seen their economic indicators plummet.

Trade Dynamics

- Global goods trade is expected to grow by only 1% this year.

- This is merely a quarter of the annual average for the past two decades.

Considering the crucial role trade plays in economic activity, such underwhelming performance is bound to act as a significant drag on global growth.

Broader Economic Slowdown

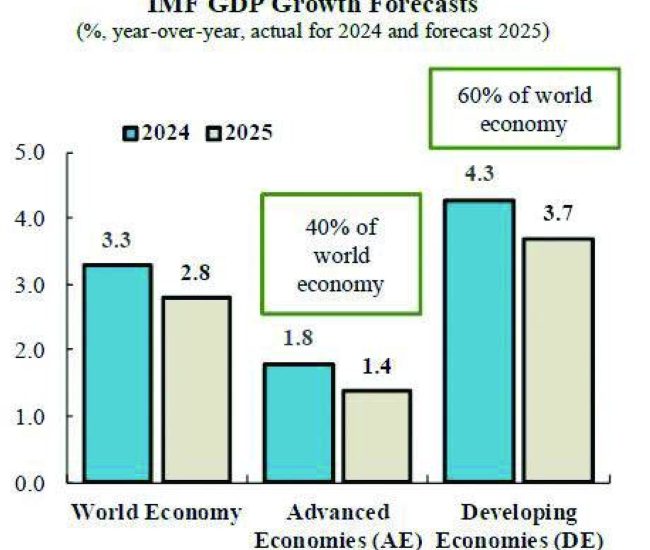

This economic shock extends across various geographies. In Advanced Economies (AE), growth predictions have been substantially lowered. The US is now expected to grow at merely 1.8%, down a full percentage point from last year. Even in countries where trade forms a smaller GDP fraction, such as the US, sweeping tariffs have had dire consequences.

Advanced Economies Impact

- AEs, encompassing 40% of the world economy, could see growth dip to 1.4%.

- Other developed regions, like the Euro Area, Japan, and the UK, are also facing downgrades.

Developing Economies (DE)

In Developing Economies, too, growth is expected to slow. Emerging and Developing regions in Asia and Europe, along with Latin America and Sub-Saharan Africa, face subdued forecasts. Interestingly, only the Middle East and Central Asia are likely to show improvement relative to last year.

Developing Economies Forecast

- Growth rate anticipated to fall to 3.7%.

Tighter Financial Conditions

Moreover, financial conditions have become harder than anticipated. Sovereign yields in AEs began rising as major central banks initiated monetary policy tightening cycles in 2022. Despite rate cuts from the US Federal Reserve and the European Central Bank, long-term yields have remained historically high.

Financial Market Dynamics

- Real costs of debt are near their highest in more than a decade.

- Rising yields and wider corporate yield spreads pose additional challenges.

Increased borrowing costs are hampering both investment and consumption, throwing further obstacles in the path of economic recovery.

Conclusion

In summary, the global economic outlook has seriously deteriorated since early this year. The combination of waning international trade prospects, widespread economic weakening, and tighter financial conditions is weighing heavily on consumption and investment. For a deeper understanding, one might refer to the World Economic Outlook (WEO), crafted by the IMF, which remains a reliable benchmark for global economic analysis.

For more related stories, you may find this article on Vodafone Qatar’s Network Operations noteworthy.