- September 11, 2024

- Posted by: Regent Harbor Team

- Category: Business

Main Street Owners Grapple with Uncertainty as Sales Expectations Drop

Small Biz Cool Down

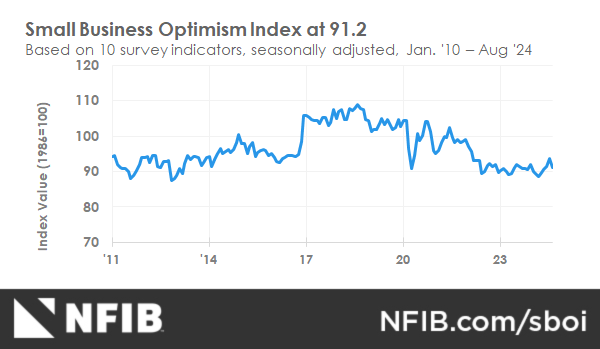

The NFIB Small Business Optimism Index took a nosedive in August, slipping by 2.5 points to a shaky 91.2. Yeah, all those gains from July? Kiss ‘em goodbye. This makes it the 32nd month in a row below the 50-year average of 98. Plus, the Uncertainty Index soared to 92, the highest it’s been since October 2020. Inflation’s still the big beast, with 24% of business owners naming it their top headache, though that’s down a tick from July.

Bleak Outlook

“The vibe on Main Street darkened in August, even after some good news the month before,” said Bill Dunkelberg, NFIB Chief Economist. “High inflation keeps hitting owners while sales expectations tank and cost pressures rise. Uncertainty’s through the roof, and future business conditions look bleak,” he added.

Even in Minnesota, the news strikes a chord. John Reynolds, NFIB State Director, echoed, “This dip’s a big deal around here and nationwide. Main Street’s really feeling inflation’s pinch, facing workforce shortages and shrinking margins. When small businesses report their worst profit trends in 14 years, folks in St. Paul and Washington, D.C. should be on alert. Especially if the Small Business Deduction gets the axe next year.”

Key Insights

Here’s a quick rundown of the major findings:

- Profit Trends: Reports on positive profit trends hit a net negative 37%, the lowest since March 2010.

- Inflation Woes: Twenty-four percent pointed to inflation as their biggest issue, a slight dip from July.

- Sales Outlook: Owners expecting higher real sales volumes dropped to a net negative 18%.

- Compensation Plans: A net 20% plan to raise compensation in the next three months, a bit up from July.

- Pricing Dynamics: The net percent raising average selling prices dipped to 20%.

Hiring and Workforce Challenges

According to NFIB’s latest jobs report, job openings hit a seasonally adjusted 40%. That’s up two points from July. Still, 90% of owners trying to hire in August complained about a dearth of qualified applicants.

Capital Expenditures and Sales

On the bright side, 56% of owners reported capital outlays in the last six months. Breakdowns? Here you go: 40% on new equipment, 21% on vehicles, and 18% on facility expansions or improvements. Eleven percent spent on new fixtures and 5% snapped up new buildings or land. As for plans for the future, 24% aim for capital outlays in the next half year.

Inventory and Pricing

- Inventory Levels: No big moves here. The net percent reporting inventory gains stayed flat at a net negative 9%.

- 11% saw their stocks go up while 18% reported reductions.

- Price Adjustments: The net percent of owners raising average selling prices fell to 20%. And while 24% said inflation’s a major issue, 15% reduced prices and 34% raised them.

Price Hikes Across Industries

Here’s who’s raising prices:

- Finance: 52% up, 3% down.

- Retail: 47% up, 8% down.

- Construction: 33% up, 16% down.

- Manufacturing: 33% up, 7% down.

Seasonally adjusted, 25% expect more price hikes soon.

Compensation Woes

On compensation, it’s a mixed bag. A net 33% reported raising wages, unchanged since July and the lowest since April 2021. Meanwhile, 20% plan on bumping up pay in the next quarter. Labor costs remain a headache for 9%, while 21% griped about labor quality, trailing just behind inflation.

Profits and Loans

It’s rough out there:

- Profit Trends: Again, a net negative 37%, with 31% blaming weaker sales and 17% pointing to costlier materials.

- Loan Access: Three percent couldn’t get all their loans met, while 26% had all they needed and 60% weren’t looking for any.

Survey Background

The NFIB Research Center’s been gathering this Small Business Economic Trends data for ages, quarterly since 1973 and monthly since 1986. The upshot? Thousands of small business owners speaking out. This latest survey took place in August 2024.

For the nitty-gritty details, you can read the full NFIB report here. We won’t blame you if you need a stiff drink after!