- September 27, 2025

- Posted by: Regent Harbor Team

- Category: Global Economy

markdown

Contents

The Interest Rate Conundrum

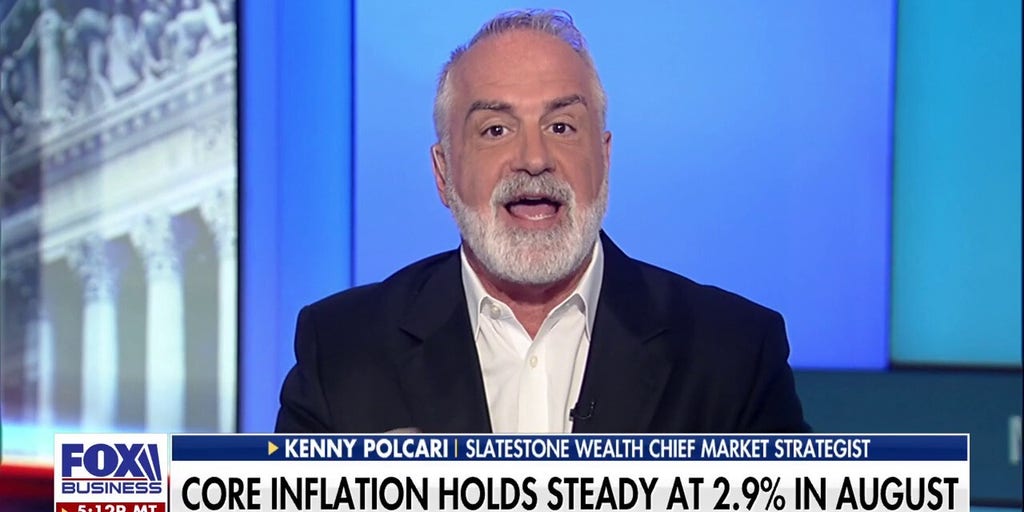

It’s something of a puzzle these days: should we cut interest rates to boost the market? Wealth experts, like the one from Fox Business, are saying there’s “no reason” to do so. But let us delve into this matter further.

Current Economic Climate

Many argue that the economy is already showing signs of healthy growth. Interest rates should remain stable to prevent overheating. It’s a debatable point, but some economists agree that cutting rates now might do more harm than good.

The Risks of Cutting Rates

Lowering interest rates could lead to increased borrowing. While this may stimulate the market in the short term, it carries the risk of inflation. There’s also concern about creating an unsustainable asset bubble.

Consider this table on potential risks:

| Risk | Impact |

|---|---|

| Increased Borrowing | Short-term market boost |

| Inflation | Reduced purchasing power |

| Asset Bubbles | Potential market crash |

Historical Precedents

History offers lessons. In situations where rates have been cut prematurely, markets have faced volatility. The 2008 financial crisis is a stark reminder. Unwise rate cuts can compound problems rather than solve them.

Transition to Stability

Now, let’s turn to the broader picture. Economists recommend a focus on stability over short-term gains. With employment rates steady and consumer spending solid, drastic monetary policy shifts could be ill-advised.

Moreover, strategists suggest using fiscal policies to address economic sluggishness. Infrastructure investments and tax incentives might spur growth more sustainably than slashing interest rates.

International Comparisons

Looking internationally, countries like Japan have shown the pitfalls of prolonged low rates. Their economic stagnation serves as a cautionary tale for those keen on immediate rate cuts.

Conclusion

To sum up, while the temptation to stimulate the market through rate cuts is understandable, it is equally crucial to prioritise long-term economic health. The balance lies in calculated, well-informed decisions, a sentiment echoed by wealth experts.

Ultimately, as we navigate these uncertain times, maintaining an eye on history and a grip on current economic indicators will serve us well.