- April 7, 2025

- Posted by: Regent Harbor Team

- Category: Business

**Source: [CNN](https://www.cnn.com)**

## Opening the Floodgates: The Tariff Chaos Continues

It’s been nothing short of a roller-coaster ride, and the markets are yet to steady themselves. Carnage ensued as US stock futures took a nosedive following two brutal sessions that erased an astounding $5.4 trillion in market value. Come Monday, the S&P 500 was teetering dangerously on the edge of a bear market. Quite an ominous precursor for both investors and the broader economy.

## A Deep Dive into Market Frenzy

Sunday wasn’t a serene end to the week. Dow futures fell 1,250 points, or 3.3%, while the S&P 500 futures dropped 3.7%. Not to be outdone, Nasdaq futures plummeted by 4.6%. Across the Pacific, [Asian markets were in turmoil](https://www.cnn.com/2025/04/06/business/japan-nikkei-plunges-hnk-intl/index.html) too, with Japan’s Nikkei slipping 8% at the open.

It wasn’t just stocks feeling the pinch. Oil prices are taking a beating as well, dipping over 3% to under $60 a barrel. Investors are jittery, fearing tariffs might spiral the global economy into recession, drying up demand for essential fuel-driving sectors.

### Crypto’s Ride: Bitcoin’s Tumble

Bitcoin, the digital gold, didn’t escape the sell-off, dropping 5.6% to a modest $78,736.93. Post-Trump election euphoria had catapulted it over $100,000, expecting his policies might bolster cryptocurrency support. Alas, those hopes seem dashed, at least for now.

## Trade War Tremors: Analyzing The Impact

Last week was a nightmare, as the markets rebelled against [Trump’s vast tariff regime](https://www.cnn.com/2025/04/05/business/tariffs-trump-baseline/index.html). Starting Saturday, hefty tariffs were slapped, with more ominous waves expected. China hit back aggressively with a 34% tariff on all US goods, fueling fears of an escalating trade war.

### The Federal Perspective

Jerome Powell from the Fed acknowledged the tariffs’ more aggressive nature than anticipated. He admitted these could hike prices and decelerate economic growth. While not in immediate action mode, the Fed is closely monitoring tariffs’ economic impacts.

## Rumbles Across Wall Street

Recession fears have gripped Wall Street tightly. JPMorgan rang alarm bells, warning these tariffs could ramp up American taxes by a staggering $660 billion annually. The Consumer Price Index might ascend 2% as importers face and pass these costs onward to consumers, making everything pricier across the board.

In case you were wondering, [Goldman Sachs isn’t too optimistic either](https://www.cnn.com/2025/04/04/business/video/jp-morgan-trump-tariff-recession-lead-digvid). They’ve bumped their recession probability in the next year to 35%.

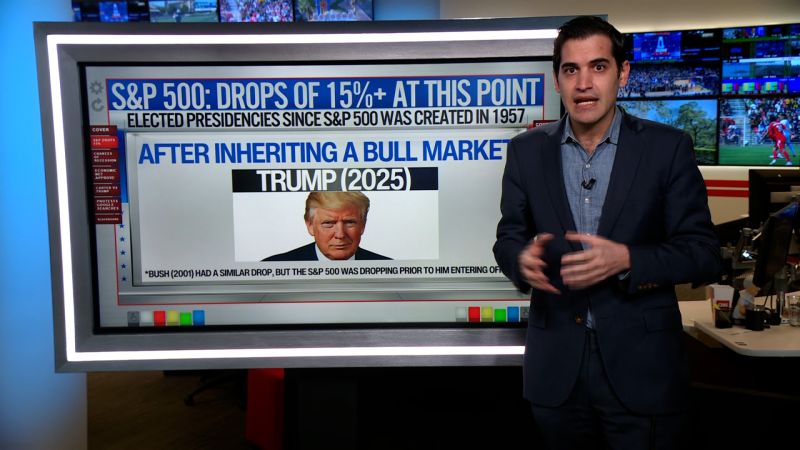

### This Isn’t the ’80s: Major Drop Alert

Markets have splashed red. The Dow, dipping over 10% since December’s high, is in correction territory. The Nasdaq slipped into a bear market, off by more than 20%.

And, the S&P 500 isn’t spared either, poised to open in a bear market after a 17.4% slide since its February high. This is some serious déjà vu from 2020’s market crunch.

## Trump’s Stance: “Let’s Make Deals”

At the helm is President Trump, who remains unfazed, conversing with global leaders regarding tariffs. He reassures that these are just growing pains toward ensuring a more resilient economy. Despite the uncertainty, the President is “open to talks,” aiming to tackle the deficit issues with trading partners such as China and the EU.

Commerce Secretary Lutnick emphasized that tariffs aren’t mere talks—they’re coming. Trump, however, notes his weekend conversations with tech executives and leaders were “very nice,” a potential olive branch perhaps for future negotiations.

## Conclusion

The ship isn’t steady in uncharted waters, and we might just be getting started. Investors are eyeing historic lows backed by fear-infused selling, possibly leading to rebound opportunities. Demmert of Main Street Research hints at a sooner-than-later market bottom, signaled by the deep, emotion-driven sell-offs. Could there be rallies over the horizon? Looks like we just need to ride the storm out to find out.

This story has been updated with additional content.

This New York-flavored take unravels the tariff tales with a candid mix of skepticism and optimism, sprinkled with links and anchored words to update opinions and insights powered by the original source.