- June 18, 2025

- Posted by: Regent Harbor Team

- Category: Business

markdown

Flying High: The Changing Face of Aviation Insurance

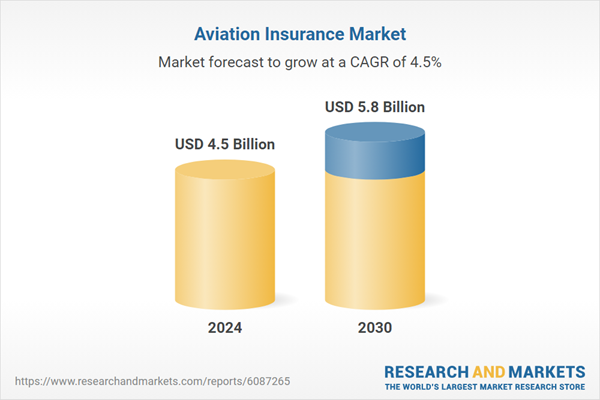

Oh, the skies are abuzz, and so is the world of aviation insurance. We’re talking big numbers here—like billions of dollars big. According to a report from “ResearchAndMarkets.com”, the aviation insurance scene is set to grow from $4.5 billion in 2024 to $5.8 billion by 2030. Not bad, huh?

What’s Boosting the Insurance Market?

As airlines recover post-pandemic, demand is skyrocketing. Fleet expansions, aircraft leasing, and travel trends are driving up the insured asset base. But it’s not so simple; systemic risks like cyberattacks and climate changes add extra layers of complexity. Hence, advanced risk transfer solutions are in vogue, along with captive reinsurance structures.

Beneath the Surface: Why Insurance is Key

Aviation insurance is more than a legal necessity; it’s strategic armor. With travel roaring back, and new players like drones and private jets joining the fray, risk portfolios are getting trickier. Insurers are dealing with inflated repair costs and higher claims. PSA: Aviation insurance isn’t just about compliance anymore.

Digital Transformations and Specialized Coverage

So, digital’s where it’s at. Platforms are shaking up policy issuance, claims, and risk reporting, making life easier for operators and service providers. We’ve got policies now for cyber liabilities and unmanned systems. And let’s not forget the ESG-linked coverage options popping up, following sustainability mandates.

Growth in the Global Insurance Atmosphere

Zoom out and you’ll see a global panorama with distinct regional highlights. Asia-Pacific, the Middle East, and Latin America are buzzing with growth. They’re modernizing fleets and infrastructures like it’s going out of style. North America and Europe aren’t slowing down either; their complex environments demand layered insurance solutions.

Market Movers: Airlines, Cargo, and Beyond

Commercial airlines are still the top dogs in buying aviation insurance. Think fleet hull, passenger liabilities, and third-party exposures. Meanwhile, business jets, charters, and helicopters are forging their own paths, requiring unique policy mixes. Cargo operators are stepping up too, given global freight booms and valuable shipments.

What Lies Ahead?

The industry’s horizon is filled with digital twins and blockchain documentation. Telematics is making risk monitoring smarter. As the aviation world embraces greener fuels and new technologies, insurance models must evolve. The burning question: Can these models keep pace with a more agile and eco-conscious aviation landscape?

Here’s a snapshot of some key insights:

| Region | Growth Areas |

|---|---|

| Asia-Pacific | Regional carriers, fleet updates, infrastructure investments |

| Middle East | New routes, airport expansions, modernized fleets |

| Latin America | Fleet modernization, airport development, regulatory harmonization |

| North America | High premium volumes, complex risk environments |

| Europe | Mature market dominance, robust insurance frameworks |

So, dear reader, the future looks vibrant, complex, and full of opportunities. Aviation insurance is not just navigating the skies; it’s charting a whole new map. Now, that’s a ride worth watching.